Page 1 of 4

RIT Capital Partners

Posted: June 15th, 2020, 8:10 am

by OllyDrod

Noticed on Friday that RIT Capital Partners (RCP) has had a fairly terrible June is now at a rare ~6.5% discount (per MorningStar, Zscore -1.64). There doesn't appear to be any obvious reason for this, though its gearing is reasonably high at 18%. Has anyone seen anything? Topped up this morning and will do so again if the discount continues to widen.

- OllyDrod

Re: RIT Capital Partners

Posted: June 15th, 2020, 8:48 am

by monabri

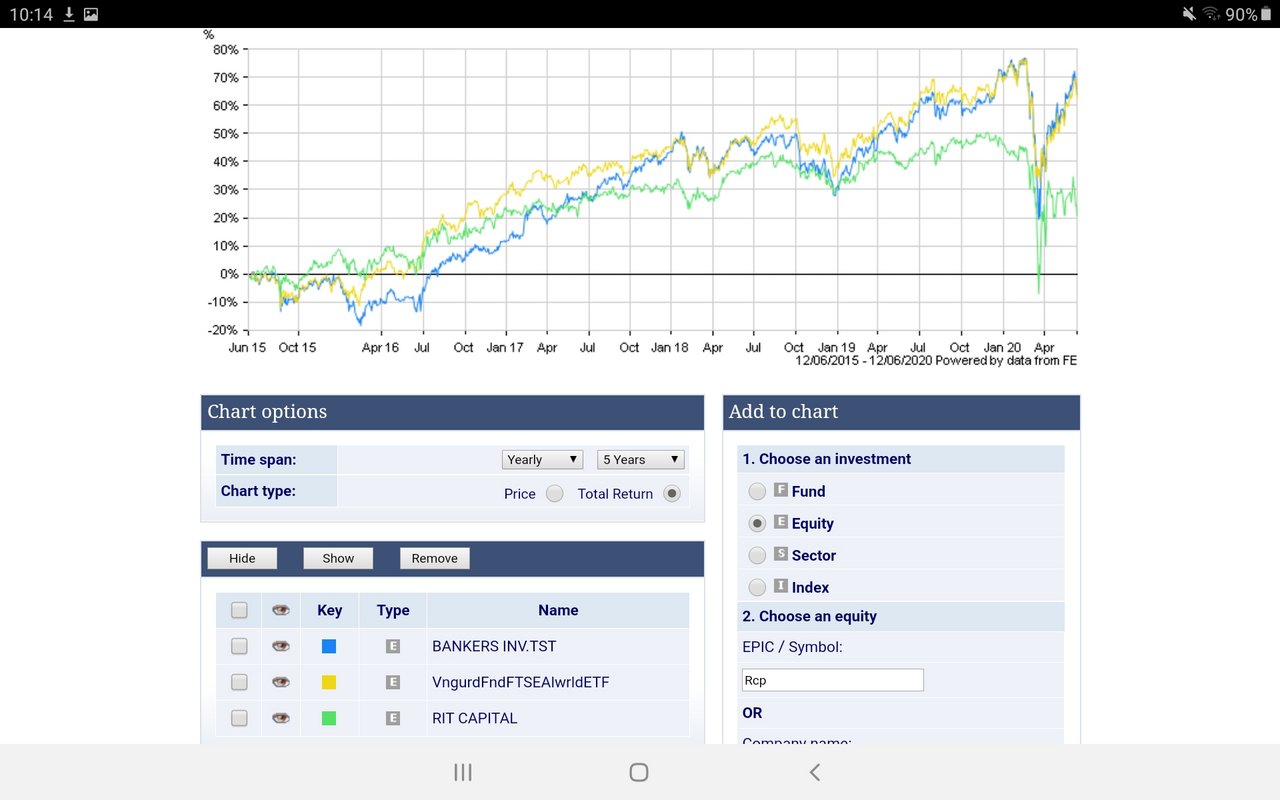

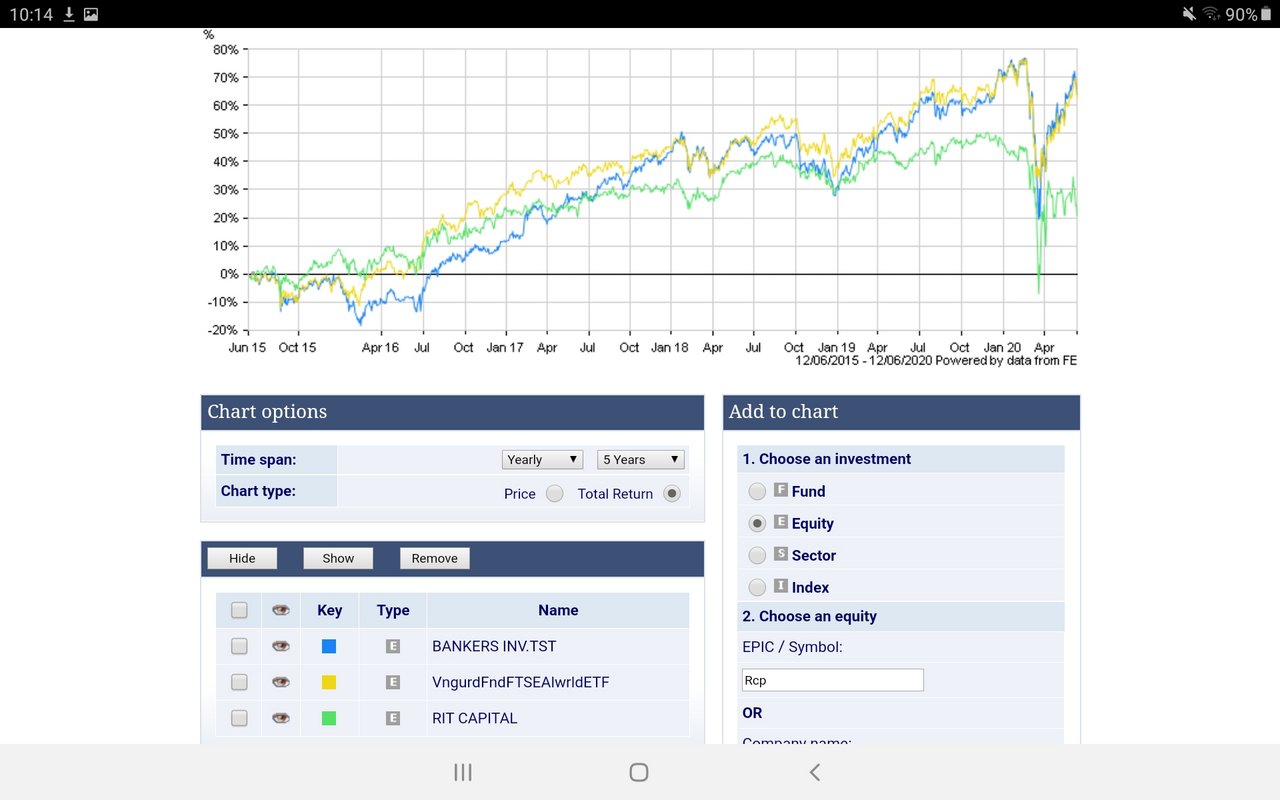

I don't see the attraction...the fund is significantly underperforming when compared to something like Vanguard's global tracker ( VWRL).

Code: Select all

Investment | 3 months | 6 months | 1 year | 3 years | 5 years

RIT CAPITAL | -2.65% | -18.49% | -13.81% | -4.08% | 20.73%

VngurdFndFTSEAlwrldETF | 20.9% | -1.74% | 3.7% | 17.82% | 62.77%

Of course past performance is no guide etc....

Re: RIT Capital Partners

Posted: June 15th, 2020, 8:50 am

by Parky

Looks even better this morning as May 31st NAV of 1898p announced, which makes the discount to NAV more than 10%.

Re: RIT Capital Partners

Posted: June 15th, 2020, 8:56 am

by Dod101

This has been a good trust over any sensible period and if it is available at a good discount at the moment it is probably worth buying. It is usually at a premium.

Dod

Re: RIT Capital Partners

Posted: June 15th, 2020, 9:00 am

by monabri

Their benchmark is quoted in their factsheet as "MSCI All Country World Index (50% £)"...hence the comparison to a global tracker as an initial, readily available comparison in the HL comparator tool.

Of course, the data above is only over the last 5 years...perhaps over longer RCP will outperform.

Re: RIT Capital Partners

Posted: June 15th, 2020, 9:19 am

by Dod101

monabri wrote:Their benchmark is quoted in their factsheet as "MSCI All Country World Index (50% £)"...hence the comparison to a global tracker as an initial, readily available comparison in the HL comparator tool.

Of course, the data above is only over the last 5 years...perhaps over longer RCP will outperform.

Interesting, thanks.

Dod

Re: RIT Capital Partners

Posted: June 15th, 2020, 9:34 am

by richfool

This is the Citywire table showing performance of Flexible trusts. RIT Capital Partnrs is 9 out of 19 over 1 year and 17/20 over 3 months:

https://citywire.co.uk/wealth_manager/i ... ePeriod=12

Re: RIT Capital Partners

Posted: June 15th, 2020, 9:39 am

by LittleDorrit

As a reminder this excelent post lays out the long term performance, wiping the floor with the index.

viewtopic.php?f=54&t=23790#p315767From memory it helps that it started life on a large discount of up to 30%, possibly due to the large private equity component.

Re: RIT Capital Partners

Posted: June 15th, 2020, 10:09 am

by bluedonkey

AIC gives RIT's 10 year total return as +89%. Does seem a touch mediocre.

Re: RIT Capital Partners

Posted: June 15th, 2020, 10:19 am

by monabri

bluedonkey wrote:AIC gives RIT's 10 year total return as +89%. Does seem a touch mediocre.

Over the last 5 years even closet tracker Bankers IT has significantly outperformed RCP.

"Closet tracker"......" Bankers "?

Re: RIT Capital Partners

Posted: June 15th, 2020, 10:32 am

by SalvorHardin

The main reason for the underperformance is that in the past four months RIT Capital Partners' share price has moved from a premium of up to 10% to NAV to a discount of as much as 10%. A movement of this magnitude on its own causes the share price to fall by 18.2% (1 - 90/110 = 0.182).

Open-ended funds by their nature cannot experience price movements like this. No wonder it's underperforming in the short term. Investment Trusts generally underperform in falling markets because their discounts have a habit of widening. Rapidly widening discounts plays havoc with the comparative performance in recent years and makes open-ended funds look brilliant compared to investment trusts.

Large movements in the discount/premium can work the other way. Over a decade ago I managed to buy some Caledonia Investments shares at a discount of almost 40%. Not long afterwards the shares had moved to a discount of just 20%. That's a share price increase of 33% purely because of the change in the discount (again you can't get this from an open-ended fund).

As others have pointed out, RIT Capital Partners' Long-term performance is superb and outperforms its benchmark by a substantial amount.

Re: RIT Capital Partners

Posted: June 15th, 2020, 10:45 am

by bluedonkey

I just don't get how RIT is interpreted as having great long term performance. Per AIC, it has similar 10 year return as Murray International which seems to generally be regarded as a rather pedestrian performer. This can't all be explained by the current unusual discount for RIT.

Re: RIT Capital Partners

Posted: June 15th, 2020, 10:57 am

by Dod101

I have held RIT for a long while and my impression certainly was that its long term performance was very good as SH has just said. Besides, it holds a lot of investments that I would not be able to access otherwise and that is useful diversification.

Dod

Re: RIT Capital Partners

Posted: June 15th, 2020, 11:06 am

by SalvorHardin

bluedonkey wrote:I just don't get how RIT is interpreted as having great long term performance. Per AIC, it has similar 10 year return as Murray International which seems to generally be regarded as a rather pedestrian performer. This can't all be explained by the current unusual discount for RIT.

For some of us 10 years is not long-term (I have several shareholdings that were bought over 20 years ago). The comments about its performance since 1988 below come from RIT Capital Partners' website and can be found in its 2020 monthly factsheets, with the figures being as of 31st December 2019:

"Since listing on the London Stock Exchange in 1988, RIT has generated a share price total return of 12.2% per annum for its shareholders. £10,000 invested in RIT at inception in 1988 would be worth ~£367,000 today (with dividends reinvested) compared to the same amount invested in the ACWI which would be worth ~£90,000."https://www.ritcap.com/about-us(ACWI is the MSCI All Country World Index)

And as Dod has said, RIT Capital Partners offers us diversification that we can't get by investing ourselves.

Re: RIT Capital Partners

Posted: June 15th, 2020, 11:24 am

by LittleDorrit

Blue,

The answer to your question is that 10 years is not long term.

My battered copy of "A random walk down wall street" set out to demonstrate that long term in terms of volatility is 25 years. Nothing much has changed in the intervening 30 years.

Have a look at page 1 of the RCP annual report to appreciate the long term.

Interestingly the LSE have reintroduced reasonably long term charts on their revamped website. Set the RCP chart to max and overlay SMT, todays star.

A possible barbell combination?

https://www.londonstockexchange.com/sto ... mpany-pageNote these are price, not total return charts, but both have had low yields for most of their life - so the correlation to total return should be reasonable.

Re: RIT Capital Partners

Posted: June 15th, 2020, 11:34 am

by Dod101

I am glad to have my impression confirmed. I have about a dozen shares that I have held for more than 20 years, and of course short termism is a very easy trap to fall into. No share rises for ever, however good a performance it may turn in.

Dod

Re: RIT Capital Partners

Posted: June 15th, 2020, 11:37 am

by LittleDorrit

The alternative viewpoint is that with the retirement of Lord Rothschild as chairman any exceptionalism has been diluted, or even dissipated all together.

Re: RIT Capital Partners

Posted: June 15th, 2020, 11:43 am

by mc2fool

Note: that's vs the FTSE World

index, so currency differences will apply. I couldn't find a suitable GBP denominated comparative.

Re: RIT Capital Partners

Posted: June 15th, 2020, 12:06 pm

by bluedonkey

Sorry guys, I'm trying not to troll but ... could it be said that given the 10 year result is pedestrian, you're picking out a period over which RIT does in fact do well?

I too have owned shares for more than 10 years.

I accept that RIT gives diversification that more conventionally oriented trusts do not.

Perhaps the conclusion is that past performance, etc is no guide and what counts more is the culture as a guide to the future.

Re: RIT Capital Partners

Posted: June 15th, 2020, 12:46 pm

by Dod101

LittleDorrit wrote:The alternative viewpoint is that with the retirement of Lord Rothschild as chairman any exceptionalism has been diluted, or even dissipated all together.

He has only been retired for 9 months or so and the same investment team is in place as before. The last few months have hardly been the best conditions to make any judgement what with a G E and then the virus.

Dod