Page 1 of 1

Cost of transferring property into joint names

Posted: June 25th, 2023, 11:15 am

by richfool

My property is currently in my sole name.

I have since married and was thinking of adding my wife to the ownership, as joint tenants, to simplify things for when I pass away. When asking a local solicitor for a quote I was quoted: £500, which seemed rather a lot. The property is mortgage free and there would be no financial considerations (i.e. no money changing hands between us). Does anyone know what one would expect to pay for adding my wife, or if indeed it is something that a layman like myself could do oneself.

Alternatively, would it be simpler and equally effective (it would be cheaper) to change my will to pass the property to my wife upon my passing, and would there be any other implications such as in the event of me requiring/incurring care homes fees, or indeed IHT? If I will'd the property to her, would the same legal transfer then be be required upon my passing at a cost of c £500?

In the meantime I propose to seek a couple of alternative quotes.

Re: Cost of transferring property into joint names

Posted: June 25th, 2023, 11:25 am

by scrumpyjack

I did it about 10 years ago and as I recall it was only about £150, though I was having a new will done at the same time. £500 does sound over the top for something so routine, though it does vary a lot depending on where the solicitors are. London solicitors are ludicrously expensive in my experience

Re: Cost of transferring property into joint names

Posted: June 25th, 2023, 12:09 pm

by monabri

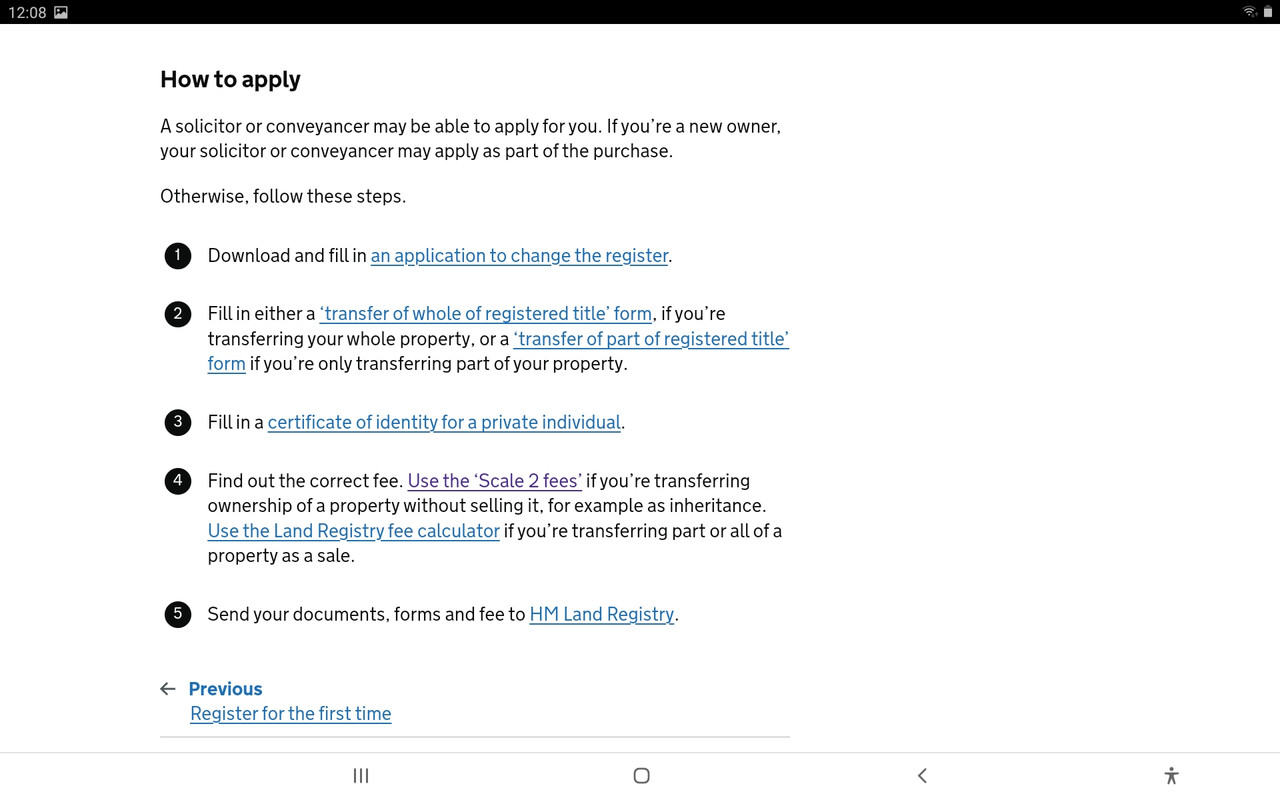

Can it be a DIY?

https://www.gov.uk/registering-land-or- ... -propertyW"You must apply to HM Land Registry to change the registered owner name for a property if you’re either:

- the new owner of a property

- adding

someone else as joint owner"

Re: Cost of transferring property into joint names

Posted: June 25th, 2023, 12:43 pm

by Adamski

If your wife's name is not on property she'd need probate to transfer the property. Much easier in joint names. Also putting partners name on at least one utility bill a good idea for ID purposes.

Re: Cost of transferring property into joint names

Posted: June 25th, 2023, 12:54 pm

by richfool

Adamski wrote:If your wife's name is not on property she'd need probate to transfer the property. Much easier in joint names. Also putting partners name on at least one utility bill a good idea for ID purposes.

Yes, that's a good point, - that depending on my other assets, having the property in joint names could obviate the need for probate upon my demise.

(Wife is already on most utility bills, and has loads of ID etc).

When I raised the suggestion of transferring the property into joint names, (with my solicitor some years ago), he advised against it, saying it would weaken my hand in the event of a matrimonial breakup, or, if for example, my wife sought to borrow money against the security of the property, or possibly maybe makes her a more attractive target to a future suitor/manipulator with ill-intentions.

The other aspect I don't know about, is whether having it in joint names would give greater protection in the event of me needing to pay care home fees.

Re: Cost of transferring property into joint names

Posted: June 25th, 2023, 2:02 pm

by Lootman

richfool wrote:Adamski wrote:If your wife's name is not on property she'd need probate to transfer the property. Much easier in joint names. Also putting partners name on at least one utility bill a good idea for ID purposes.

Yes, that's a good point, - that depending on my other assets, having the property in joint names could obviate the need for probate upon my demise.

That is the over-riding factor for me - anything that makes probate easier, or even not needed at all, is desirable. My aim is to eventually hold everything jointly with my wife (who is a decade younger than me). That would mean giving up my ISA and premium bonds however, neither of which can be held jointly.

Also note that a joint tenancy can always be severed later if needed, by either party. That cost about 600 quid when I did it a few years ago.

Re: Cost of transferring property into joint names

Posted: June 25th, 2023, 2:43 pm

by richfool

Lootman wrote:richfool wrote:Yes, that's a good point, - that depending on my other assets, having the property in joint names could obviate the need for probate upon my demise.

That is the over-riding factor for me - anything that makes probate easier, or even not needed at all, is desirable. My aim is to eventually hold everything jointly with my wife (who is a decade younger than me). That would mean giving up my ISA and premium bonds however, neither of which can be held jointly.

Also note that a joint tenancy can always be severed later if needed, by either party. That cost about 600 quid when I did it a few years ago.

If I may digress onto the probate aspect for a moment (ignoring the property, or assuming that that is already in joint names). As I have equity and cash ISA's, surely probate will be required for those, assuming the balances are upwards of about £25K (or whatever), (and perhaps dependent on the actual manager's requirements), doesn't probate then require all one's assets to be listed, e.g. including smaller accounts, current accounts, etc, in one's sole name etc, (down to the electric toothbrush!?

).

Re: Cost of transferring property into joint names

Posted: June 25th, 2023, 2:56 pm

by Lootman

richfool wrote:Lootman wrote:That is the over-riding factor for me - anything that makes probate easier, or even not needed at all, is desirable. My aim is to eventually hold everything jointly with my wife (who is a decade younger than me). That would mean giving up my ISA and premium bonds however, neither of which can be held jointly.

Also note that a joint tenancy can always be severed later if needed, by either party. That cost about 600 quid when I did it a few years ago.

If I may digress onto the probate aspect for a moment (ignoring the property, or assuming that that is already in joint names). As I have equity and cash ISA's, surely probate will be required for those, assuming the balances are upwards of about £25K (or whatever), (and perhaps dependent on the actual manager's requirements), doesn't probate then require all one's assets to be listed, e.g. including smaller accounts, current accounts, etc, in one's sole name etc, (down to the electric toothbrush!?

).

Yes, probate would be needed anyway for an ISA of any size because it cannot be held jointly. Nor can you gift an ISA.

So to avoid probate you would have to first sell any ISA and then place the resultant cash in a joint account. But you would then lose the ability of your spouse to add its value to her ISA allowamce.

But if all assets are held as joint tenants then there would be no need for probate. And if all assets are left to a spouse then there is no IHT wither.

Re: Cost of transferring property into joint names

Posted: June 25th, 2023, 3:35 pm

by brightncheerful

When asking a local solicitor for a quote I was quoted: £500, which seemed rather a lot

Approximately 2 hours' work. 15-30 minutes on ID check. Same again for paperwork. 50% profit. Sounds reasonable to me. Chances are the solicitor wouldn't be interested in taking on the instruction.

When I am asked how much I charge for my line of work in commercial property, I ask for more information before answering. Assuming the information is forthcoming I either decline if the rent level is below my minimum for taking on work from new clients or if not then have a look at the property on google street view and my answer on whether to become further involved depending upon whether it would interest me.

Re: Cost of transferring property into joint names

Posted: June 25th, 2023, 4:02 pm

by richfool

brightncheerful wrote: When asking a local solicitor for a quote I was quoted: £500, which seemed rather a lot

Approximately 2 hours' work. 15-30 minutes on ID check. Same again for paperwork. 50% profit. Sounds reasonable to me. Chances are the solicitor wouldn't be interested in taking on the instruction.

When I am asked how much I charge for my line of work in commercial property, I ask for more information before answering. Assuming the information is forthcoming I either decline if the rent level is below my minimum for taking on work from new clients or if not then have a look at the property on google street view and my answer on whether to become further involved depending upon whether it would interest me.

I am an existing customer of the practice, (so ID already established for both of us), located in a not wealthy SW English town. They have done a Will for me previously and these changes will likely necessitate a new Will. Maybe I should ask if the fee includes a new Will as well!

Re: Cost of transferring property into joint names

Posted: June 25th, 2023, 4:42 pm

by Lootman

richfool wrote:They have done a Will for me previously and these changes will likely necessitate a new Will. Maybe I should ask if the fee includes a new Will as well!

The act of placing an asset into a joint tenancy should not by itself necessitate a new Will. It merely removes that asset from the scope of your current

Will.

Of course that act would potentially disinherit whomever would currently inherit your house, and so you may wish to compensate them for that.

Re: Cost of transferring property into joint names

Posted: June 26th, 2023, 5:55 pm

by Charlottesquare

richfool wrote:brightncheerful wrote:

Approximately 2 hours' work. 15-30 minutes on ID check. Same again for paperwork. 50% profit. Sounds reasonable to me. Chances are the solicitor wouldn't be interested in taking on the instruction.

When I am asked how much I charge for my line of work in commercial property, I ask for more information before answering. Assuming the information is forthcoming I either decline if the rent level is below my minimum for taking on work from new clients or if not then have a look at the property on google street view and my answer on whether to become further involved depending upon whether it would interest me.

I am an existing customer of the practice, (so ID already established for both of us), located in a not wealthy SW English town. They have done a Will for me previously and these changes will likely necessitate a new Will. Maybe I should ask if the fee includes a new Will as well!

Get them to also throw in a POA (though the registration fee for us was a fair chunk of the total cost)

Re: Cost of transferring property into joint names

Posted: June 26th, 2023, 5:58 pm

by scrumpyjack

It's very easy to do POA's yourself. Really no point in getting a solicitor to do it if you are a normal sensible and literate person!

Re: Cost of transferring property into joint names

Posted: June 29th, 2023, 12:19 pm

by mutantpoodle

interesting thread

I have just been quoted £895 (plus VAT) to move from sole name into two names (am not in London)

no mortgage, no debts etc etc

will be studying the forms in the link earlier shown!!

Re: Cost of transferring property into joint names

Posted: June 29th, 2023, 12:24 pm

by monabri

scrumpyjack wrote:It's very easy to do POA's yourself. Really no point in getting a solicitor to do it if you are a normal sensible and literate person!

There's two forms to fill in - one for "medical" and one for "financial" decisions....and two fees!

Re: Cost of transferring property into joint names

Posted: June 29th, 2023, 1:16 pm

by DrFfybes

A friend works for a law firm in London for relatively high end clients, who often buy the new house before selling the old one or overlap properties to make things easier. Their standard charge for reclaiming Stamp Duty is £1200 +VAT.

I did it once, took nearly 10 mins.

Paul

Re: Cost of transferring property into joint names

Posted: June 29th, 2023, 1:21 pm

by Lootman

DrFfybes wrote:A friend works for a law firm in London for relatively high end clients, who often buy the new house before selling the old one or overlap properties to make things easier. Their standard charge for reclaiming Stamp Duty is £1200 +VAT.

I am surprised in that situation that the buyers don't just "forget" to mention to their conveyancer that they already own a property, and so only pay the basic stamp duty rate. As long as they do then sell their prior home, it makes no difference.